Dear Dads,

When our children are young, money is such an abstract idea to them. For most, they aren’t able to comprehend basic money concepts until age 3. However, in only four short years, by age 7, their money habits are largely set. So, what financial lessons are we teaching our children, and what habits are we helping ingrain in them?

By the time your child has come into some Tooth Fairy or allowance money, it’s important to have had talks about money and finances. It can be tempting to gloss over the complexity of fiscal responsibility, but we owe it to our children to break it down for them.

The conversation isn’t as simple as “Money helps us buy things.” We need to teach our children how the value of money is calculated: how it’s earned, how it grows, and that paying yourself or your savings first is always a good idea. Dads, you might even learn a bit about your own financial beliefs when you find yourself having to articulate it to a child.

It is in these young years that we have to impress on them that the proverbial money tree does not exist, and that they will have to be the strongest proponent of their own financial success. Teach them lessons that will serve them while young, and long-term strategies that will help them understand how they want to achieve long-term financial goals.

For young children, help them create a plan to save for a long-desired toy. Teens may want to save for a car when they get the taste of freedom that comes with a driver’s license. Twenty-somethings in their first jobs may have plenty of questions about what a 401k really does. This is your time to shine, Dads. Help them be proud of the financial goals that they can achieve within a few months, and the long-term plans to set them up for success in the future.

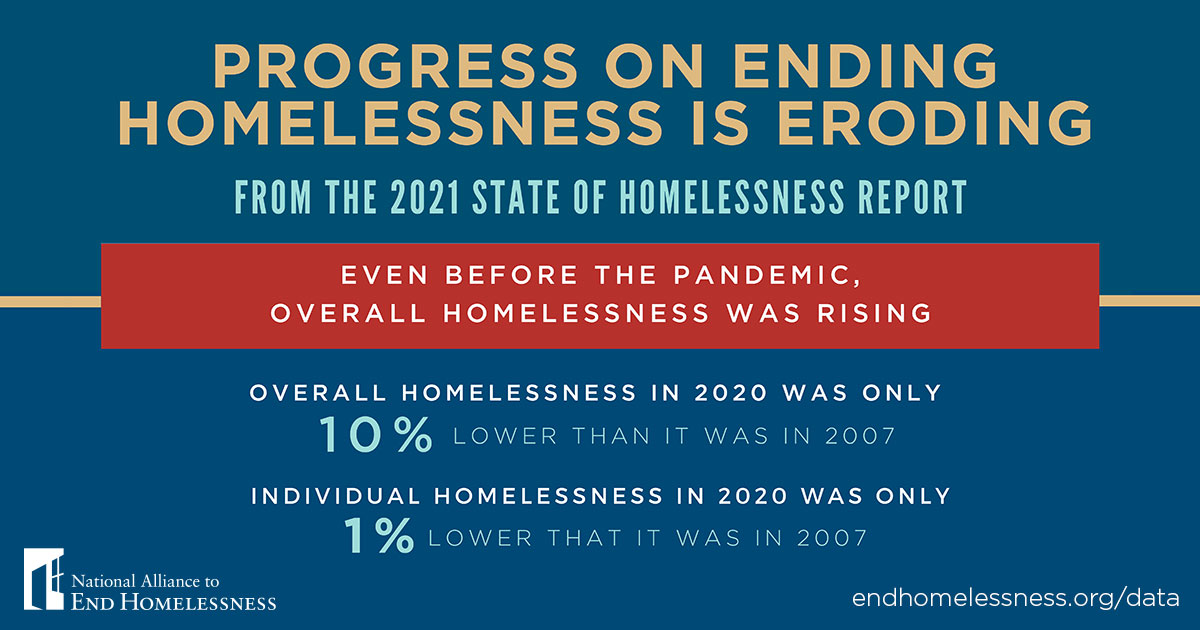

One last note, Dads. As a former homeless person, I would be remiss to ignore the impact of financial disparity in our current climate. This is yet another, albeit a somewhat adjacent, lesson for our children. We cannot equate financial worth with the worth of a person. Whether it be systemic oppression or challenges, the current economy, or one of another million reasons, people’s financial security will vary, and they are not worth less because of it.

So, let us teach our children how to save, the true value of a dollar, how to have some fun along the way, and as always, kindness.

Chris